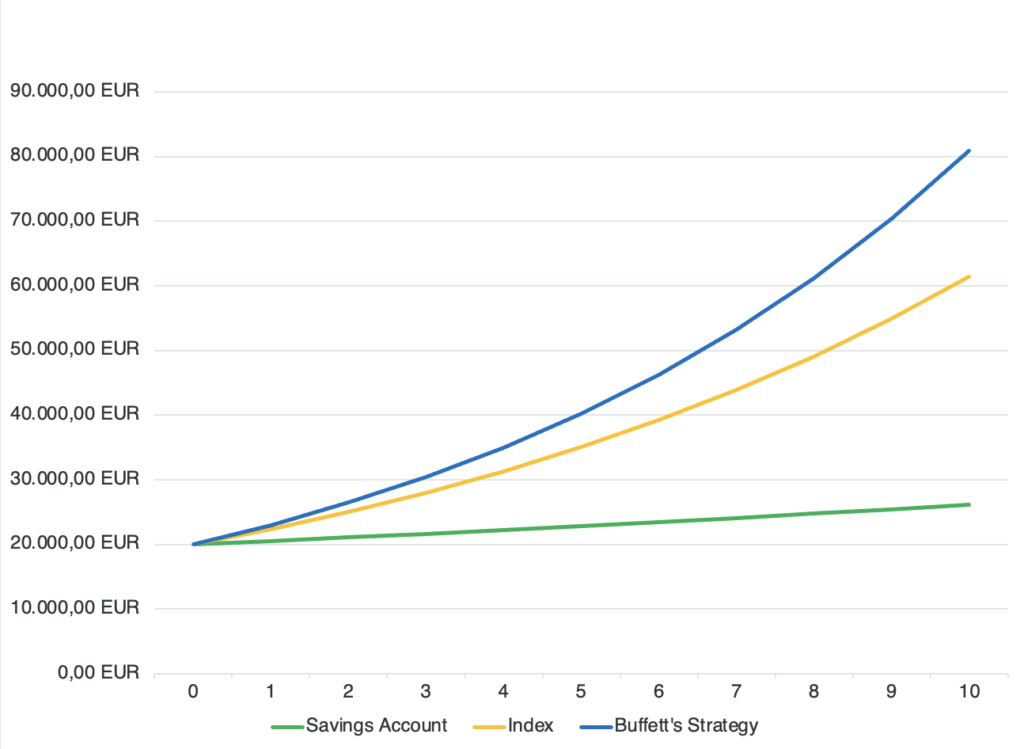

“My money is just stored in my bank account”. In a meeting today I was speaking to a young woman, well on her way in her career and a clever and bright person. Her story inspired me to write this and to share the graph below.

The graph illustrates the difference between a high yield savings account (interest rate of 2,70%), investing in an American stock index (with an average return of 11.88%) and using Warren Buffett’s strategy as an individual investor (a conservative 15% return). Please note that the graph is not adjusted for inflation.

Dust in the Savings Account

The woman explained how she had amassed quite a lot of savings, yet the money was just collecting dust in her bank account. The interest rate on the account was tiny – under one percent. But at least the interest rate was positive now. For several years she had been paying to save due to the negative interest rates. For years the European banks didn’t pay out interest but instead collecting money from customers who chose to save.

She was aware that inflation was eroding the purchasing power of her money. We all know that prices of food and many other things have increased significantly over the past two years; this is what I mean by the erosion of spending power. The 5 Euros in her savings account could buy her a cup of latte at a café in 2021, but not anymore.

Though she knew about these factors, she had not gotten the courage to start investing. She didn’t want to lose all her savings and she had seen how her husband had made some trades in the stock market. What she experienced made her think of a casino rather than something safe and secure. To her the actions seemed stressful and unreliable.

A New Approach

I explained to her how Warren Buffett’s investing strategy was a very low risk and long-term approach. That it wouldn’t be like a casino or a lottery but that his method was a solid strategy for growth. Over the course of 60 years Buffett has consistently grown his wealth without gambling but by using common sense.

The reason it’s so important to invest is so you have money to spend in the future. You need a savings account that yields higher than 3% to outpace average inflation. And to multiply your money you need more than 3% rate of return. The way to achieve that is to invest in stocks and for some people like me and the young woman, we opt for the low-risk way and to “set-it-and-forget-it”. This way we can avoid monitoring the stock market all the time or becoming stressed about market conditions.

0 Comments